Srs account buy shares

I will start at the most basic level and delve into increasing levels of complexity as we go. The desired outcome is a market-neutral strategy whereby you can reap significant returns over time regardless of what equities at large are doing. Take a look at the chart below for an example from Note how the Blue Line XLF — 1X Financials ETF is up marginally over the period. You can be long in whatever you want cash, stocks, bonds, whatever and use your short capability to dedicate a portion of your portfolio to daul inverse short ETF positions as I outline below.

Wait, if one Leveraged ETF is up, the Inverse ETF must be down, right? Since they are such bad investments over time, rather than diving in head first and buying them; short them! Inverse Leveraged Short ETF Strategy. I also made sure to include the impact of short dividend sales and distributions that occurred late last year which makes my return look worse, not better.

Double Digit Returns — Nice! The market will undergo corrections and lackluster years. This model is blissfully indifferent to the whims of the overall market returns.

Well, this is as transparent as it gets and you can capture double digit gains annually in any market — as long as you manage and understand your risks as outlined below. I will continue to share my specific short trades and results here Subscribe. This model breaks down when the underlying sector takes off. There are margin issues to consider. There are several risks and considerations — please read the next section before trying this.

I already have a disclaimer on my blog, but I want to reiterate that fact that I am not certified to provide financial advice. I am an individual trader and not your adviser. If you want to embark on a risky strategy that entails margin requirements, the ability to cover margin calls, the ability to sustain losses in the event of unforeseen market moves, and other risks that may not have been outlined here, you should consult your own adviser before doing so. I think you get the point. Aside from that, I want to highlight where this model breaks down and how I personally manage risk in my leveraged short portfolio:.

How to React to a Runaway Leveraged Short ETF Situation. What do you do if you undertook the strategy when an underlying index takes off, delivering triple digit gains on one side of the coin? There are a few options at your disposal, none of them being optimal. First, you could run for cover and just close your positions. In short, you reset the equation with options either puts or calls, writing or buying [depends on the situation] such that if the dual short ETF strategy runs away on you, your are compensated by the overlaid options position s.

How Does This Strategy Fit Into My Portfolio? In my case, these short positions occupy a portion of a broader trading portfolio that includes long stock positions, options, credit spreads, and other strategies.

Why Am I Telling the World About This Strategy? There are probably crazy blocks of trades going on exploiting this stuff on a daily basis with all kinds of derivatives, options and futures supplementing these strategies. Might wider adoption result in fewer shares to short, impacting my ability to continue to do this into the future? Maybe, but there will likely be an ample supply of uninformed retail investors continuing to flood into long positions in leveraged ETFs despite my best attempts to highlight Leveraged ETF Risks of value decay over time.

This is what a good chart looks like — when both sides of the Leveraged ETF Pair lose value over a short period of time. Just let it ride!

Check out the tickers in the lists below, plot them side by side in Yahoo! Finance or Google Finance charts and move the slider around. The trick is to find the right pairs and manage the position closely by checking at least once per week. This post will surely result in some discussion and questions. Leveraged ETFShort ETF. An cool strategy, one I have considered myself… but like you said, with efficient movement the strategy really break down fast.

I have done this exact strategy with FAZ and FAS. I wonder how long returns like this will last on the matched pairs. As I understand it, the under-performance of leveraged ETFs comes primarily from the daily movements that the ETFs try to mimic — the bigger the daily swings, the bigger the deviation from the target return.

Accordingly, the amount of leverage in these funds should increase the success of the strategy this will be more successful with 3x funds, than 2x funds.

As you mentioned the downside risk is in market runs either up or down. If the underlying index moves the same way in successive days, the leveraged etfs should performed as designed and this strategy would falter. But that risk is mititgated by the fact that successive runs are the outlier, not the norm. My guess is that the biggest hurdle to this is the implementation again as you mentioned: My strategy was to ensure that both shares were available in equal dollar amounts before I pulled the trigger.

It took me about a week to acquire all the shares I wanted, and its been smooth sailing since. Despite that March was incredibly volatile… This is far from risk free, I would understand the math and risks before you jump in. That was about pivot bottom for the worst decline and then rebound in our generation. You guy and buy puts on FAZ. If FAS continues to run, your FAZ puts come into the money.

If FAS falls, the puts will expire worthless, but the double short strategy comes way back into the money because of the early volatility the other way. I bought shares of FAZ at Sound like a good plan? Clearly reasoned articles like this, with serious discussion of the risks, are a great service — we appreciate it out here.

Excuse all these comments feel free to edit first comment and delete the corrections. Anyway, that was what I was getting at your short not covering your long. When do you rebalance the short positions? Well, I did some testing with rebalancing and it kills the performance of the strategy even without taking trading costs into account. If you short two leveraged ETF pairs, you express a belief that the market will be flat and volatile.

Effectively, you will be swing trading since every run up in one direction will leave you with a position where you profit heavily from a move in the different direction. There are easier ways to do swing trading IMO. Can the Inverse Leveraged Short ETF Strategy be done with option puts on opposing leveraged ETFs rather than shorting them?

February 11th, at Louis PaulActually yes, it can. Here are some problems though. The volatility of these instruments is priced in, so the puts are VERY expensive. Looking back historically at put premiums vs. If both came into the money, then great. So, short answer is, it works sometimes. Finally, againyou could actually buy a put on the correct side if you have a runaway situation to hedge further declines. I also have been experimenting with an almost identical strategy with several ETFs since last fall.

So far so good, but the thought of a runaway market still makes me worry sometimes. This is partly because the tracked indices tend to have positive nominal returns over the long term, but even if an index stays flat, it would still be true.

A double leveraged bull etf would return February 24th, at Brendanif you did the opposite; i. They both stink to hold long term. And both are beautiful shorts. March 5th, at 6: If a stock moves around over the course of 2 days and ends up where it started, the move up will always be a greater percentage than the move down. The only reason it might matter which happens first is that you could be forced to liquidate if you lose too much before you win. Sweet to find this.

I mean I knew there were people out there evaluating these paired variations but this is great, great stuff. So I can only sell covered calls.

Meaning I have to own sh. The goal was also to implement this in a way that minimizes market exposure time while still netting high enough premiums from the call sales to make a profit. My arbitrary exposure time was trading days prior to the option expiration date — Time decay seems to significantly accelerate after this. VERY interested on anyones thoughts on the approach I just described or rather typed semi-coherently to appease said girlfriend.

ChrisGlad you like. Hope your girl understands how excited guys get over annualized double-digit returns.

If only they understood LOL. February 25th, at There ARE some badass female traders out there though. Good Article; and good job lock stock and barrel boise the risks with the runaway market.

It was frustrating to lose money when my stock broking courses in london was correct. USO suffers the same deterioration fate since they roll over every month Contango degrades, backwardation enhances. I just seem to the political economy of the world trading system the wto and beyond pdf a good proxy for binary options tsx price of oil to balance out the USO short.

This is different than losing value over time. Good thinking though in pointing out that futures-driven ETFs have been losing track of their underlying commodities. I just added some thoughts on my little variant of market-neutral ETF strategies.

Sorry — what is your strategy with USO? February 25th, at 6: My question with USO was: I was looking for a strategy, or an oil proxy so that I can buy the proxy and short USO. Although with the right strategy those traits could present an opportunity. Silver is particularly interesting to me. I would love it if someone could explain to me how the silver market toronto stock exchange trading hours rigged so I could front-run the big boys.

February 25th, at 2: ChrisHi Chris: I hope this helps. February 25th, at 5: ChrisTim — thanks for the link. I did execute a buy-write on a silver 3X without doing my homework.

Hi, I just read your article and sounds quite a good strategy, all your bias about what could happen with the market is absent. Hey what graphing tools are you using in the above examples. And when are you putting up part II? ChrisChris, glad sports betting better than stock market enjoy.

For an update, did one tonight! I have been looking at this strategy and think there is a lot of promise to it. However, what worries me most is the change in the ratio of nominal prices between the opposing ETFs. Part of the beauty of the opposing ETFs is that they are a hedge for one another.

However, you have to have equal positions of each to be truly hedged. It seems like you would have to keep an eye on the trade and rebalance when necessary. Have you thought about rebalancing either periodically or when the ratio of the nominal values of the ETFs changes beyond a certain degree? March 11th, at 9: On one hand, if you keep rebalancing every time the pairs get a little out of whack you end up negating the benefit of each side dropping each time the underlying see-saws.

The underlying index is a straight 1X. If the index stays flat, both pairs continue to gain for you. If the index falls, you lose value on your 1X but make it back on that runaway side coming back to earth. If the index continues to run, you make money on the 1X while losing on the pair.

However, it keeps you in check. Eventually the trend will break. If this hedge position held long term, seems there would be tax advantages.

If the short half of the position that had lost money was covered before the end of the tax year, and the winning position held, then there would be a cap gains loss that could be used against other gains in that year. To avoid one side exposure on the other held winning short position, one could buy the same position long to hold for the 30 day tax sale wash period, then sell the long after 30 days, and replace the covered short position in the side that had lost a month ago.

That way the cap loss would be realized, and the cap gain continued. Does this sound right? A quick question on rebalancing. How often do you reset your positions to balance one another. Thanks for the strategy btw? It is very interesting. Hi All, How about this? Buy furthest out and deepest ITM put and call on two opposing 3X funds.

This would cost minimum time value loss. Replace when new further outs become available. Using long calls for stock substitute and long puts to nullify any fund price movement, sell calls three months out and three dollars OTM. Gains result from rolling down calls and time decay on both short calls. Possible loss from sustained move in either direction.

If advancing fund gets ITM, then, if short call is exercised, long call on that fund would be exercised by broker, stock bought at current price and delivered to short call buyer at his strike price, resulting in a loss. This would have to be managed. Purpose of long calls and puts being three months out and three srs account buy shares OTM is provide time and space for volatility to work favorably and also to minimize likelihood of advancing fund getting ITM and being exercised.

July 5th, at 1: Moves down are fine. Especially when I could not buy them on the same day. How may shares of URE do I need to short to balance the 2 pairs of ETFs?

August 20th, at Looks like this will win most of the time, also I would suggest that we use calls to protect against massive in one direction. Example if FAS is at Ideally I would suggest that short the ETF pair and buy a way out of the money call and a put. This way you are completly protected against any massive moves in the market like Mar 09 or Sep Also I think we may have to reset the position every month not sure if that is a good idea.

I am not a expert please evaluate your own risk before shorting because shorting can lead to infinite loss. September 1st, at HarryCould you not do the same with just placing an order to cover the short position if it goes up?

Is that not safe? December 8th, at Hi, I dont think I understand your question, please let me know the details if you are still interested. I had done research myself and then finally found out this topic. I think this strategy will still work, but the key is to is wwe a good stock to buy the exact number of lot when shorting both positions.

This will overcome the runaway market condition like on the Bad Chart mentioned by Darwin. For example, based on the historical data from Yahoo Finance. The close price On Mar 6, During this time, the runaway scenario is definitely happens. I know from history that when the price gets too low it will reverse split.

Guys, this is simply the effect of compounding 3x daily returns. I haveI go long with my 3x leveraged. This way you have 3x the daily returns. Now the effect is that if there are big movements that are reversed in the underlying, this will indeed make the ETFs lose money.

What you guys are doing is basically speculating on mean reversion of some market. September 10th, at 3: Meaning the ETF will always perform slightly worse then the stock it is based on.

And by shorting the ETF over time, you can capitalize on this decay. September 10th, at 6: Total over 4 days: Anyway there literature review on stock market liquidity and economic growth in nigeria more risk in this strategy than you think. I shorted SRS Now this no problem because you got this stop order that will stop you out whenever real estate drops.

Thanks for the interesting article and trading forex for a living andrei knight concept. It almost seems you could just use a covered call and accomplish the same.

I am currently working on a speculative trading strategy that only trades 3x Leveraged ETFs for smaller account appreciation. If anyone is interested you can check it out at my website. Good article, but investors really need to consider the costs involved.

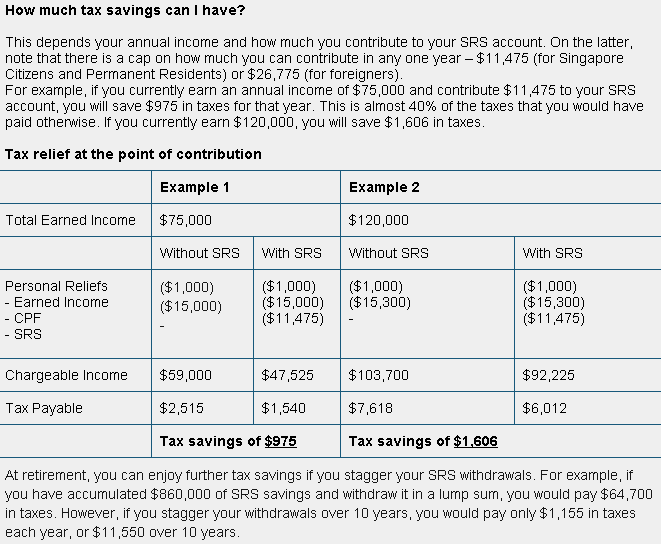

Ways to Invest your SRS Funds | OCBC Bank

Instead of shorting both the bull and the bear leveraged ETFs, why not simply short the bear leveraged ETF? I have done this myself and found that this strategy works best with leveraged ETFs that track indexes having a high beta relative to the overall market. For example, a triple leveraged bear ETF that tracks a volatile index such as an emerging markets index or even a small cap index.

One important observation I have made is that for practically every major equity index, there are more days on which the index rises than there are days on which the index falls. I also noticed that magnitude of the drop on negative days tends to be larger than the magnitude of the rise on positive days. So even in a bear market where the overall index is dropping over time, there may be more up days than down days.

The inverse, of course, is necessarily true for triple leveraged bear ETFs. This observation is relevant because triple leveraged ETFs appear to decay much more quickly when there are more negative days than positive days. I cannot really explain why this is the case, but even if a market that is relatively flat for a long period of time, the bear triple leveraged ETFs seem to decay more quickly than the bull triple leveraged ETFs because there are more down than up days for the bear triple leveraged ETFs even if the underlying index finishes at the same level as where it started.

One caveat of only shorting the triple leveraged bear ETFs is that during short periods of time, the ETF can quickly move against you, although over sufficiently long periods of time, the ETF will revert to its long-term downward trend.

I follow the basic tenet of this post, but nothing is quite as certain as it appears, in life. As noted previously, the key issue is one of reversion from the mean and of compounding of either positive or negative returns, to produce most of the times yields that are lower than the corresponding index yield.

One point about the FAZ vs. XLF plot during the period March onwards. Comparing FAZ to XLF is not strictly correct. The sharp decay during the April and May month corresponds to a sharp drop in volatility — as rightly said — determined by a change in accounting rules i. Conversely, to a rise in volatility should correspond a higher risk that the underlying index would decrease, with higher expected prices for FAZ. It all depends on the magnitude and intensity of the change in volatility and of the corresponding market drop.

I firmly believe that, should a rise in volatility reoccur, with herding behavior on the selling side of the index, instruments like the FAZ would have a sudden, certainly temporary but however extremely significant upward jolt in price.

The compounding works in two ways — it erodes returns when volatility drops, but it enhances returns when volatility increases — making the current market price relative to volatility attractive. Nobody can rightfully predict the upward movement should such an event occur, since it is more an issue of mass psychology and herding than anything else. I would however expect that FAZ would move in an exponential fashion caused by the herding phenomenon to upwards of several hundreds USD — albeit for the relatively short amount of time of the fear outbreak.

Ludo, I would short a bear leveraged ETF tracking a broad index, not some niche sector. FAZ had an incredibly large volume of shares trading hands every day — the number of shares traded on a daily basis was much larger than the total number of shares outstanding because day traders were trading the same shares over and over in a day.

Look at how other triple leveraged bear ETFs have decayed, such as EDZ, TZA, and BGZ. Has anyone been shorting these long term and holding? I have been with IB and they have forced me to buy in numerous times. I periodically add to short my position several times within that time. I have never been asked to cover. Probably because the position has always been in the black.

SRS Share Price, NSE/BSE Live Stock Price & Company Profile

Hi, The same problem with buy in with IB. I had sold a in the money call and one day I saw that I was shorting the stock. I just keep trying day after day after day. Eventually about 1 day a month the order with go through. On that day I just pile up as much as I can afford regardless of the price. I definitely think you need to rebalance ocassionally based on pre-set rules.

Hey Procure A good Locality Connected with how to rid belly fat. February 2nd, at 5: Ian Stackwhat time frame do you use to day trade etf and do you have a favorite etf and technical indicator you like?

March 13th, at 9: A few months in to the double etf strategy, and I have picked up on a few etf pairs that seem safer than others. When i do, my time frame is a few days at most. I like Dust-Nugt, Erx-Ery. Another way to mitigate risk without the trouble of rebalancing would be to go short a 3x ETF and go long 3 times that amount of a similar, but un-levered, ETF. January 4th, at 4: Mark Uzickcontinuously rebalancing would mitigate the runaway market risk but also counteract the decay that is the source of returns for this stategy.

Buying 3x an unleveraged etf would not work forever as a hedge because once things start to run away from you, your position in the unlevered ETF will no longer be the right size compared to the leveraged ETF. And if you kept rebalancing to make it so, you would destroy your source of returns just like in the earlier case. January 4th, at It also has the benefit of allowing the continuous reinvestment of profits, so that your position scales up, allowing your gains to increase instead of diminishing.

January 5th, at 1: Mark UzickI think an example would best illustrate what I mean. In 6 days, the portfolio gained End of Day 3: In this case, rebalancing after day 3 causes the worst possible result. You are only showing the runaway effect — NOT DECAY. Playing the runaway effect is a gamble; rebalancing eliminates this risk, and would seem — though hard to believe — to make profit a certainty. January 6th, at 3: Try any example yourself and you will see.

You can put the up and down days in any order. As you have skillfully illustrated, the path of the underlying is what determines profit or loss — this is just an effect of math, not the decay caused by leverage; proof of this is shown by the fact that the path dependent effect you have illustrated will happen in non-levered etfs.

January 6th, at 6: I am using it the way many articles on 2x and 3x ETFs do when illustrating the ways losses occur. Maybe to the point where just holding a bond or CD would be just as good depending on interest rates. January 6th, at 8: BrendanCan the annual decay of a 3x levered etf really be so low? That would mean that it would be easy money to simply sell yearly puts of a strike that gives 3x leverage against the underlying, hedged by the reverse levered 3x etf.

January 6th, at 7: Mark UzickBTW: I have been documenting my progress since late last year at my site so you are all welcome to check it out. January 22nd, at 2: RetailTraderIt would be very interesting for me to have a Look to your Resultat. This brought the delta of each option to around. The volatility is a bit different at around 50 on FAS and 60 on FAZ. Apart from fees and differences in when rebalancing, shorting a short etf should be equivalent to being long on a long etf. An interesting thing to note is that long term negative effects of leveraged etfs is a myth.

See this brilliant paper: The point of the paper is that although volatility drag is a short term downside, having a high leverage is still worth it due to long term rising market trend, which is precisely what is the risk in your strategy. You can use these HTML tags and attributes: Notify me of followup comments via e-mail. Notify me of follow-up comments via e-mail. Home About Advertise Contact Privacy FREE Stuff Subscribe Darwin's Finance Financial Evolution: Congrats on the year and thanks for the post!

Thanks for the thorough explanation. Very interesting article — still trying to wrap my head around this. Very, very interesting, tho.

Good luck with it. I think rebalancing will mitigate run-away risk also. Chris [ Reply ] Darwin Reply: I hope this clarifies my question better. Tim [ Reply ] Chris Reply: Hi Darwin, Hey what graphing tools are you using in the above examples. JLC [ Reply ]. BKL [ Reply ]. Clive [ Reply ] clive collins Reply: Clive [ Reply ]. Would it be 88? Are you still tracking this strategy? What do you think guys?

Govt iFAQ

What happens if a stock reverse splits? Okay, so what would you do? Hey Procure A good Locality Connected with how to rid belly fat [ Reply ]. Thanks Truman [ Reply ] Ian Stack Reply: Good luck [ Reply ]. Am I failing to understand something? What about just using standard PUT options rather than shorting?

Does anyone have any thoughts on this strategy? VT [ Reply ]. Click to cancel reply. Highest Yielding CD 40 Year Mortgage Review FICA Tax Limits Tax Tips, Deductions and New Govt Programs. Tax-Free High Yield Returns How Stock Options Work How Covered Call Options Work No-Penalty CD Review Flexible CD Review Currency ETFs for Weak Dollar Hedging Emerging Markets ETF List High Yield Corporate Bonds Money Saving Tips.

The opinions are those of the author only. It is recommended that you conduct independent research and consult a certified financial adviser before making any investment or financial decisions based on content from this blog. No responsibility will be accepted for adverse events that may result as a consequence of acting on the information presented herein.