Investment policy statement for pension plan

Started by Guest Grumpy , April 16, A colleague who does a lot of work on participant-directed DC plans told me earlier today that virtually all DB plans have adopted an investment policy statement.

In my experience, I have not seen any DB plans with investment policy statements granted, I work on smaller DBs--generally under participants. I am just wondering whether other DB folks 1 see IPSs on their DBs and 2 , if they do, how they go about defining the investment objectives. In the case of a DC plan, it is easy to see a disgruntled participant suing the plan for breach of fiduciary duty resulting in poor returns.

In the case of a DB plan, the company simply puts more money in the plan if the assets underperform the actuarial assumptions. Anyone care to comment? The actuarial assumptions applicable for a plan are not selected arbitrarily. One of the factors in determining the plan's funding assumptions should probably be the investment strategy policy that will be utilized.

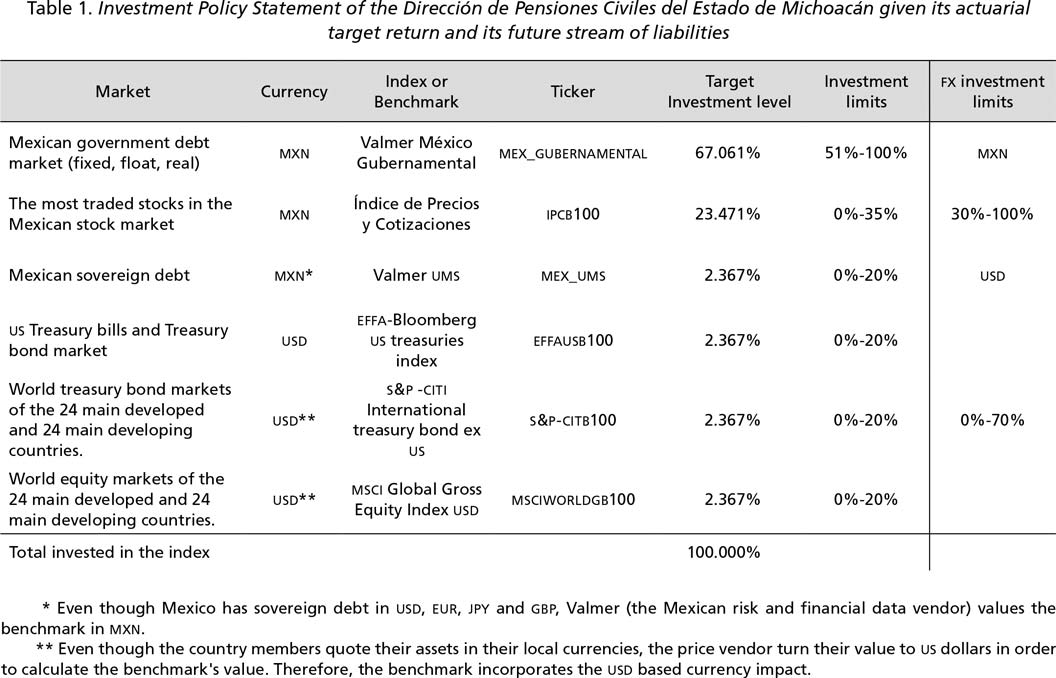

The IPS should, among other things, specify the asset allocation guidelines and should set benchmarks for evaluation of performance. One of the ASPPA exams, probably C-4, from a few years ago included in it's study material a good outline on IPS's for DB plans.

You might want to peruse their book store. One of my pet peeves is investment consultants who look at the actuarial assumption as a "target".

In a perfect world, the IPS should guide them on what sectors they should be investing in and how much risk the client wants to take. They should then be judged on how well they did against those indices during the time period. The actuarial assumption is simply a LONG TERM estimate, based on the IPS. I assume most smaller plans ignore that requirement, but then again, I'm not the investment consultant. Since the fiduciary act of managing plan assets that are shares of corporate stock includes the voting of proxies appurtenant to those shares of stock, a statement of proxy voting policy would be an important part of any comprehensive statement of investment policy.

For purposes of this document, the term "statement of investment policy" means a written statement that provides the fiduciaries who are responsible for plan investments with guidelines or general instructions concerning various types or categories of investment management decisions, which may include proxy voting decisions. A statement of investment policy is distinguished from directions as to the purchase or sale of a specific investment at a specific time or as to voting specific plan proxies.

Thus, such a named fiduciary may expressly require, as a condition of the investment management agreement, that an investment manager comply with the terms of a statement of investment policy which sets forth guidelines concerning investments and investment courses of action which the investment manager is authorized or is not authorized to make.

Such investment policy may include a policy or guidelines on the voting of proxies on shares of stock for which the investment manager is responsible. In the absence of such an express requirement to comply with an investment policy, the authority to manage the plan assets placed under the control of the investment manager would lie exclusively with the investment manager.

In the context of a DB plan it is my understanding that the plan's actuary develops a "funding policy" which is held up to a standard of reasonableness. That funding policy is ultimately designed to match the plan's assets to its liabilities of course, he know that that never happens. A plan is "properly funded" for a number of purposes: If a DB plan needs an IPS, it would seem that its benchmarks should, at a minimum, reflect the actuary's funding policy assumptions which, I suspect, relate to both return and liquidity--depending upon turnover, for example.

It would seem odd to me if the plan's IPS benchmarks created tension between the plan's funding policy and its investment policy. Isn't the plan's funding policy really the key--e. Shouldn't the plan's IPS really leave the target earnings rate to the actuary and simply outline the procedures for selecting and changing plan investments when that benchmark isn't satisfied?

Also, for DB's subject to FASB, what do the accountants say, if anything, about the plan's investment performance relative to the IPSs benchmarks?

I guess the question is what you mean by "funding policy". If it has anything to do with the investments, then I think you have the process backwards. The client and their financial advisor decide on what to invest in and the actuary should set their assumptions based on that. I once heard great i analogy What is the difference between the two you ask In other words, at the end of the plan you get the same benefit, so why pay more if you don't need too.

The more you can make on the asset side, the less cash you need to spend for the same benefit. Due to limits they can't pay out any more at the end, they just give you crappy investments and your deductions are higher because your investment performance is expected to be so bad.

Most pension actuaries are not financial consultants and have very little to do with the actual investing. We generally work on the liability side of the funding, not the asset side. There is also a big difference between large plans and small plans. Large plans tend to set assumptions a little more scientifically, looking closer at the actual investment strategy. Most companies don't want to contribute any more than they need to.

An oversimplification for a small plan would be to say the pre-retirement assumption reflects the assumed long term rate of return on the assets and the post-retirement assumption reflects the interest rate used to pay-out the benefits. For example, a typical small plan will pay a lump sum. This may change in 08 when PPA kicks in. You are also correct that there are different assumptions for different purposes. FASB provides guidance on how they want assumptions selected for financial purposes.

This process is not necessarily the same process used to set the funding assumptions. If you are really interested, the American Academy of Actuaries has published guidance on the setting of actuarial assumptions for various purposes.

It should be on their web site. It sounds as if large plans likely need an IPS more than medium or small plans. Let me put that differently. Even medium and small plans likely have investment policies, those policies just tend to be less formal and unwritten while large plans may need to have a written, clearly-articulated investment policy statement.

Is that about right? Let's also assume that the plan's actuary has selected 6. Should there necessarily be a tie between the two? How does PPA affect this? Is the investment policy supposed to be geared towards that, or is an equity gain an implicit assumption or expectation? Yes, there should be some relationship between the investment policy and the actuarial assumption, but the assumption should be on the conservative side.

If they have a good investment manager who performs well against the indices, that will produce actuarial gains and lower the cost.

The actuary will generally not assume the manager will always do better than the index since in general, all things will eventually come back to the average. My comment had to do with the fact that the interest "assumption" for Post PPA funding will be tied to the yield curve produced by the specific plan's participants.

NEPC Investment Consulting - Home

As far as determining the minimum required contribution, the ability for the actuary to set the interest assumption has been removed from our quiver starting in You need to be a member in order to leave a comment. Sign up for a new account in our community. Community Software by Invision Power Services, Inc. Today's News Search the News Benefits in the News By Date By Subject. By Date By Company Submit a Press Release. Upcoming Recorded Grouped by Sponsor Submit Yours.

Practitioner Resources Published Guidance I. Interest Rates Opinion Letters Regulations. ERISA HTML format ERISA downloadable PDF ERISA in the U. Congressional Record Joint Comm. Vendor Directory Software Directory Request a Listing Pay by Credit Card.

Vendor Directory Software Directory Request a Listing Pay by Credit Card Advertise Advertise Recommend a Link Satisfied Customers Contact Us About Us. Advertise Recommend a Link Satisfied Customers Contact Us About Us. Defined Benefit Plans, Including Cash Balance BenefitsLink Message Boards Existing user? This Topic All Content This Topic This Forum Message Board Advanced Search.

All Activity Home Retirement Plans Defined Benefit Plans, Including Cash Balance Does a DB plan need an Investment Policy Statement? Does a DB plan need an Investment Policy Statement? Edited April 16, by Grumpy Share this post Link to post Share on other sites.

Sample k Investment Policy Statement - wugadukucevu.web.fc2.com

I don't see a requirement for an invesment policy, although one would be a good idea. This is an interesting subject. Edited April 17, by Effen.

I'll take a look at the website. Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account in our community. Register a new account. Sign in Already have an account? Go To Topic Listing Defined Benefit Plans, Including Cash Balance. Theme Default Default Responsive Privacy Policy Contact Us BenefitsLink.

Sign In Sign Up. Free Daily Newsletters Subscribe See Past Issues Subscribe Past Issues. Directories Vendor Directory Software Directory Request a Listing Pay by Credit Card Vendor Directory Software Directory Request a Listing Pay by Credit Card. Advertise Advertise Recommend a Link Satisfied Customers Contact Us About Us Advertise Recommend a Link Satisfied Customers Contact Us About Us. Alabama Alaska Arizona Arkansas California Colorado Connecticut District of Columbia Delaware Florida Georgia Hawaii Idaho Illinois Indiana Iowa Kansas Kentucky Louisiana Maine Maryland Massachusetts Michigan Minnesota Mississippi Missouri Montana Nebraska Nevada New Hampshire New Jersey New Mexico New York North Carolina North Dakota Ohio Oklahoma Oregon Pennsylvania Rhode Island South Carolina South Dakota Tennessee Texas Utah Vermont Virginia Washington West Virginia Wisconsin Wyoming Telecommuting Outside U.

Jump to content Defined Benefit Plans, Including Cash Balance BenefitsLink Message Boards Existing user? Sign Up This Topic All Content This Topic This Forum Message Board Advanced Search Portal Activity All Activity Search Sign In for Personalized Activity Views Forums Message Boards Leaderboard Guidelines More Jobs Daily Newsletters Subscribe free Previous Issues News Feed BenefitsLink Home More More All Activity Home Retirement Plans Defined Benefit Plans, Including Cash Balance Does a DB plan need an Investment Policy Statement?

Share this post Link to post Share on other sites Create an account or sign in to comment You need to be a member in order to leave a comment Create an account Sign up for a new account in our community. Register a new account Sign in Already have an account? Sign In Sign Up Portal Activity Back All Activity Search Sign In for Personalized Activity Views Forums Message Boards Back Forums Message Boards Leaderboard Guidelines Jobs Daily Newsletters Back Subscribe free Previous Issues News Feed BenefitsLink Home.