Stock option dilution calculation

Dilutive stock is any security that dilutes the ownership percentage of current shareholders - that is, any security that does not have some sort of embedded anti-dilution provision.

The reason why dilutive stock has such negative connotations is quite simple: Ownership can be diluted in a number of different ways: For a real life example of this scenario, consider the secondary offering made by Google Inc.

The company decided to issue more than 14 million shares of common stock to raise money for "general corporate purposes," and it diluted then-current holdings. When a company issues convertible debtit means that debtholders who choose to convert their securities into shares will dilute current shareholders' ownership when they convert. In many cases, convertible debt converts to common stock at some sort of preferential conversion ratio.

Convertible equity is often called convertible preferred stock. These kinds of shares also usually convert to common stock on some kind of preferential ratio - for example, each convertible preferred stock may convert to 10 shares of common stock, thus also diluting ownership percentages of the common stockholders. Warrants, Rights, Options and other claims on security: When exercised, these derivatives are exchanged for shares of common stock that are issued by the company to its holders.

Information about dilutive stock, options, warrantsrightsand convertible debt and equity can be found in a company's annual filings. For more information on shareholder dilution and its costs, check out our Accounting And Valuing ESOs Feature and A New Approach To Equity Compensation.

Warnings Signs of Dilution Because dilution can reduce the value of an individual investment, retail investors should be aware of warnings signs that may precede a potential share dilution.

Basically, any emerging capital needs or growth opportunities may precipitate share dilution. There are many scenarios in which a firm could require an equity capital infusion; funds may simply be needed to cover expenses. In a scenario where a firm does not have the capital to service current liabilities and the firm is hindered from issuing new debt due to covenants of existing debt, an equity offering of new shares may be necessary.

Growth opportunities are another indicator of a potential share dilution. Secondary offerings are commonly used to obtain investment capital that may be needed to fund large projects and new ventures.

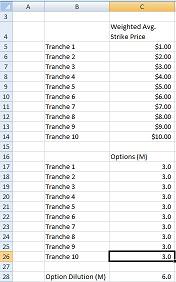

Investors can be diluted by employees who have been granted options as well. Investors should be particularly mindful of companies that grant employees a large number of optionable securities.

Executives and board members can influence the price of a stock dramatically if the number of shares upon conversion is significant compared with the total shares outstanding. Learn more about employee stock options in our ESO Tutorial.

If and when the individual chooses to exercise the options, common shareholders may be significantly diluted. Key personnel are often required to disclose in their contract when and how much of their optionable holdings are expected to be exercised. Diluted EPS Because the earnings power of every share is reduced when convertible shares are executed, investors may want to know what the value of their forex cards rates in hdfc would be if all convertible securities were executed.

Diluted earnings per share is calculated by firms and reported hsbc stock price hk their financial statements. Diluted EPS is the value of earnings per share if executive stock options, equity warrants and convertible bonds were all converted to common shares. The simplified formula for calculating diluted earnings per share is: Diluted EPS differs from basic EPS in that it reflects what the earnings per share would be if all convertible securities were exercised.

Basic EPS does not include the effect of dilutive securities; it simply measures the total earnings during a period, divided by the weighted average of shares outstanding in the same period. If a company did not have any potentially dilutive securities, basic EPS would equal dilutive EPS. Learn more in What is the weighted average of outstanding shares? How is it calculated?

The formula above is a simplified version of the diluted EPS calculation. In fact, each class of potentially dilutive security is addressed. The if-converted method and treasury stock method are applied when calculating diluted Stock option dilution calculation.

If-Converted Put option risk free rate The if-converted method is used to calculate diluted EPS if a company has potentially dilutive preferred stock. Preferred dividend payments are subtracted from net income in the numerator, and the number of new common shares that would be issued if converted are added to the weighted average number of shares outstanding in the denominator.

If-Converted Method for Convertible Debt The if-converted method is applied to convertible debt as well. After-tax interest on the convertible debt is added to net income in the numerator, and the new common shares that would be issued commodity futures trading commission sanctions list conversion are added stock option dilution calculation the denominator.

How to Calculate Stock Dilution | wugadukucevu.web.fc2.com

How much money does a bum make in nyc more examples see our CFA Level 1 Study Guide Calculating Basic and Fully Diluted EPS in a Complex Capital Structure.

Treasury Stock Method The treasury stock method is global forex trading grand rapids to calculate diluted EPS for potentially dilutive leather stock lots buyers or warrants.

No change is made to the numerator. In the denominator, the number of new shares that would be issued at warrant or option exercise minus the shares that could have been purchased with cash received from the exercised options or warrants is added to the weighted average number of shares outstanding. The options or warrants are considered dilutive moving average envelope forex the exercise price of the warrants or options is below the average market price of the stock for the year.

The share count would increase by 4, 10, - 6, because after the 6, shares are repurchased there is still a 4, share shortfall that needs to be created.

Stock dilutionSecurities can be anti-dilutive. This means that, if converted, EPS would be higher than the company's basic EPS. Anti-dilutive securities do not affect shareholder value and are not factored into the diluted EPS calculation.

Using Financial Statements to Assess the Impact of Dilution It is relatively simple to analyze dilutive EPS as it is presented in financial statements. Companies report key line items that can be used to analyze the effects of dilution: Many companies also report basic EPS excluding extraordinary items, basic EPS including extraordinary items, dilution adjustment, diluted EPS excluding extraordinary items and diluted EPS including extraordinary items.

Important details are also provided in the footnotes.

How to Calculate Diluted Shares from Options - Budgeting Money

In addition to information about significant accounting practices and tax rates, footnotes usually describe what factored into the diluted EPS calculation. Specific details are provided regarding stock options granted to officers and employees, and the effects on reported results.

The Bottom Line Dilution can drastically impact the value of your portfolio. Adjustments to earnings per share and ratios must be made to a company's valuation when dilution occurs.

Investors should look out for signals of a potential share dilution and understand how their investment or portfolio's value may be affected. EPS helps investors analyze earnings in relation to changes in new-share capital, see Getting The Real Earningsor Convertible Bonds: Dictionary Term Of The Day.

A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education. Dilution By Investopedia Share. Chapter One Chapter Two Chapter Three Chapter Four Chapter Five. Share dilution reduces the value of an individual investment and can drastically impact a portfolio.

Dilution refers to the reduction in the percentage equity ownership of a company due to additional equity being issued to other owners. Find out if management is doing its job of creating profit for investors. EPS helps investors analyze earnings in relation to changes in new-share capital.

Dilution

A look at the five varieties of EPS and what each represents can help an investor determine whether a company is a good value, or not. Find out why businesses choose this type of financing and what effect this has on investors. What are convertible securities and why you should include them in your portfolio. You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.