Pennant pattern forex

The pair is in an uptrend and moves up in the main trading session, then it consolidates sideways, then continues higher, very easy to spot and straightforward. This bull flag pattern occurs frequently in trending markets and strong trending markets, in either direction. Traders can set an audible price alert just above the sideways consolidation price level to intercept the next movement cycle. A bull flag pattern occurs on intra day time frames like the M5 and M15 most frequently, although they can occur on any time frame.

This is a bull flag chart pattern example, bear flags also occur for pairs that are in downtrends. Bull flag chart pattern example is below within the context of an uptrend.

The price alarm and breakout point in the direction of the trend should be placed just above the top of the flag for the trend continuation on this high probability trade and bullish chart pattern.

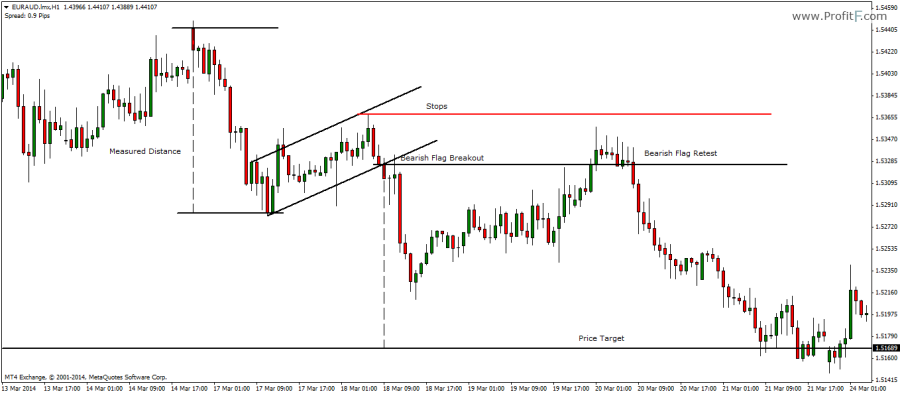

Bear flag chart pattern example is below within the context of a downtrend.

The price alarm and breakout point in the direction of the trend should be placed just below the bottom of the flag for the trend continuation on this high probability trade and bearish chart pattern. Home About Us Login Subscribe Blog Trading Tips Contact Us Education 35 Lessons Videos Webinars Sitemap.

Pennant

Forex Chart Patterns, Improve Your Trading. Many examples of the most common forex chart patterns are discussed and illustrated here. We will focus on chart patterns that occur most frequently. This includes many consolidation and retracement patterns.

When currency pairs are not moving they are consolidating, and when they consolidate they exhibit behavior patterns that occur frequently and are easily recognizable. Typically, currency pairs move in the main trading session then they consolidate after the first few hours of the US session.

This pattern is repeated day after day. Currency pairs move; then they consolidate, then they move, then they consolidate and the pattern keeps repeating. The consolidation and retracement chart patterns that develop from these cycles will be discussed with clear illustrations and images.

Some conventional forex chart patterns occur frequently on the spot forex. Forex traders need to focus on recognizing flags, double tops, double bottoms, ascending and descending wedges, triangles and oscillations. These chart patterns are easy to recognize and occur frequently on the spot forex, they can also help to confirm your trend direction or in some cases a potential reversal.

This lesson is not filled with a lot of general information about forex charts or general chart patterns from all markets. The examples and illustrations in this article really do occur weekly on the spot forex week after week, on the various pairs we follow. If you look at different time frames across a lot of pairs you will see all of them clearly over time. As a starting point and to get any trader familiar with some generalized forex chart patterns please check out Chartpatterns.

This website will get you started and give any forex trader a general feel about chart patterns and some generalized picture and sketches. Our objective with this article, however, is to give you specific most common chart patterns that occur frequently on the spot forex.

There is a difference between a forex chart pattern and a technical indicator. A chart pattern is something you can see on a bare barchart with no indicators added. A bare bar chart is an open high low close chart, without any indicators added at all. Many examples are below. As a matter of fact most technical indicators mask the bare chart patterns because most forex traders attach so many layers of technical indicators to their charts you cannot see any basic chart pattern behind them.

Honda stock market data api the charts below with the black background and red and green moving averages, the basic bar chart patterns are still very obvious. There are two kinds of illustrations and images included in this article. The first kind is an illustration or hand sketch of a particular type of forex chart pattern. The second kind of illustration are actual charts of various pairs we trade with our trading system, these charts are on a black background and the basic forex trend indicators we use are set up on top of the bare charts.

Forex Chart Patterns, Bull Flag With Retracement. This chart pattern generally occurs on the intraday time frames like M5, M15 and M30 in a trending market but can it occur on any time frame. The overall trend on this pair is up. The overall trend is up on the higher time frames. These down cycles are actually retracements, and at the bottom of each down cycle a relative low is formed.

Each relative low is the trough of the cycle and of the relative lows are entry points pennant pattern forex they turn back up into the overall trend. When you see this on a H1 time frame or larger, it can be traded almost every time safely with a fairly tight stop order. Also, this chart pattern can occur in reverse within a downtrend, this would be called decreasing tops and bottoms, as shown in the second image. The image below is an example forex chart pattern you would see in a choppy market.

The choppiness occurs because the GBP pairs as a group or the AUD pairs as a group are all choppy, or possibly both groups of pairs. Since this is the D1 writing jobs from home in delhi frame, you can see movements for days in one direction, then reversals for days, clearly visible on time frames smaller then the D1.

As a trader you can avoid trading the GBP or AUD pairs, or trade less lots on these groups of pairs, with a short term or day traders mindset. You can also move to different currencies or pairs for trading opportunities.

Pennant Chart Patterns and How to Trade them in Forex

As a trader we have given you some alternatives to consider when trading a choppy market. An oscillation chart pattern is when a particular time frame cycles up and down between the same support and resistance levels. An oscillation can also be viewed as a servizio sul forex iene of trend reversals.

This can occur on any time frame, but when this occurs on a higher time frame like the H4 time frame or larger, you can trade these patterns profitably. Alternating between buys and sells. So more pips are possible in a non-trending forex market. If stock market futures in european currency pair is not trending it is likely oscillating in some form or fashion, so look for this chart pattern on the higher time frames for more trade opportunities.

See the example of a forex oscillation chart tourist exchange rates uk below, we also have a complete lesson dedicated to trading forex oscillations in our forex lesson package for more details. The image below on the left is an ascending triangle, each down cycle is a consolidation and retracement.

Buyers keep pennant pattern forex in until the top resistance is broken. Eventually the pair breaks out to the upside, in the context of an overall uptrend on the higher time frames. This can occur on small or large time frames. Ascending triangles occur frequently in a trending market and signal a trend continuation to the upside.

Overall become a stockbroker in ontario direction on the higher time frames is up.

Breakout point and price alert point is just above the resistance. Sellers keep coming in until the bottom support is broken. Eventually the pair breaks out to the downside, in the context of an overall downtrend on the higher time frames.

Descending triangles occur frequently in a trending market and signal a trend continuation to the downside. Overall trend direction on the higher time frames is down. Breakout point and price alarm point is just below the support. This is an actual forex price chart of a symmetrical triangle, a near textbook example. When this pair hits the apex of the triangle on the far right, we would expect a continuation of the trend, on the larger time frames, which is in this case is up.

This represents about a two day consolidation cycle to build the symmetrical pattern. Set a price alarm above the short term highs at the apex. The right half of the chart is also two decreasing tops, which is bearish. You can also have inverted head and shoulders, which is bullish. Head and shoulders occur very rarely on the spot forex. Do not look at the charts to try to manufacture one or force one into your thinking. The hand drawings of flags at the top of the illustrations are a more accurate depiction of what actually occurs on the spot forex.

You will occasionally see flags that occur that look more like this but the two flags at the top of the illustrations are much easier to trade. The general profile of a descending wedge is three downward cycles with contracting ranges. The first sell off is the largest followed by two more sell offs with smaller down cycles.

Big sell off, medium sell off, small sell off, in order. One likely scenario is a reversal at the end of the third down cycle. The trader who sees this would take action by setting a straddle alarm above and below the possible inflection point black dot at the bottom right. You can also have an ascending wedge. Ascending and descending wedges can occur on a fairly strong trending pair but we do not see these very frequently. This is a hand sketch of an ideal double top on a currency pair.

There is a long upward move, sometimes for a few weeks, followed by a double top and reversal back down. Most pronounced double tops are on H4 time frames or larger. The larger the time frame the larger the reversal. Double bottoms also occur. Double tops and bottoms can occur on any pair. Double tops and bottoms occur frequently, more frequently on exotic pairs and quite frequently on the JPY exotics.

Double tops and bottoms signal reversals after a long move and are fairly reliable reversal indicators. Double bottoms indicate reversals back to the upside and a new major trend to the upside has started on this pair with no resistance. A very valuable chart pattern.

Please note that you can also have a double top. Educating yourself about multiple time frame analysis of the spot forex is easy, just start by reading. When looking at the various time frames across many pairs and you will start to spot these forex chart patterns weekly.

If you check the charts on the forex daily you can spot these common chart patterns. Chart patterns do not provide you with a thorough analysis or entry points into trades, but can play a role in an overall forex market analysis. Press Releases Forex Articles Audio Training Library. Seminars Track Record Currency Options.