Stock market crash apush

At the close of World War I, the United States found itself in a recession. Millions of veterans were suddenly looking for jobs at a time when industry was reeling from the cancellation of billions of dollars in war contracts.

In addition, shortages of consumer goods that were not produced during the war created high prices and inflation. The cost of living doubled from tocausing great distress for many Americans.

Still in shock from the horrors of fighting a modern war, Americans had little patience for economic problems. They wanted to put the war and all hardship behind them as soon as possible. Americans felt a booming business sector was the road to recovery from the recession. Anything that appeared to hamper business seemed unpatriotic and counterproductive. Union activity and strikes were viewed as socialist plots to harm the American economy and were dealt with harshly.

Americans had been horrified at the way a handful of radicals had been able to overthrow the government of Russia, and people feared that under the right conditions communists might be able to succeed on this side of the globe. In this political environment, unions were unable to negotiate effectively, and they lost a third of their membership during the s. In post-war America, the progressive reforms of the early twentieth century were viewed as being too burdensome on the economy.

The reform effort was redirected toward improved transportation, education, and public services. The old-time progressive reformers had hoped that government intervention on behalf of labor during World War I would continue into peacetime, but the War Industries Board was dissolved soon after the Armistice, and federal controls on the economy were discontinued. In the elections of the s, voters rejected progressive Democratic candidates in favor of a succession of Republican presidents who embraced laissez-faire politics.

In addition to giving a free hand to business, Americans had been so appalled by the carnage and senselessness of an all-out war on foreign soil that they believed the best policy for the U. The federal government in the s adopted isolationist policies with regard to world affairs, especially those outside the Western Hemisphere. In addition, it slowly reduced interventionism in Central America and the Caribbean. To ensure economic isolation, high tariffs were instituted. Truly believing that World War I was the "war to end all wars," America allowed its military to lapse into decay.

Business interests were given special consideration by all institutions of government including Congress and the Supreme Court.

For several reasons, laissez-faire appeared to work phenomenally well in the s. Capital that had been hoarded in the private sector because of the uncertainties of war was now made available just as the tax policies were changed to favor investment. The Federal Reserve Board kept interest rates low, which further stimulated capital formation for large business enterprises.

Advances in technology also contributed to a growing business sector. Mechanized transportation could now be powered by engines that burned petroleum fuels, and large domestic oil fields were discovered making these fuels relatively inexpensive. Assembly line and mass production techniques were perfected producing cars, trucks, tractors, and all sorts of home and industrial appliances.

Electric power plants provided clean power to homes and factories at a reasonable cost. To the nineteenth century innovations of interchangeable parts and breaking down complex operations into simple steps, the twentieth century added standardization and the time-and-motion analyses pioneered by Frederick W. Taylor to make the assembly line highly efficient.

Union officials were alarmed that workers were becoming nothing but adjuncts to the machines, but increased production was its own justification for the science of factory management. With the new chemical fertilizers and modern refinements in the factories, the productivity of both farms and industry increased.

The problem became how to find markets for all of this new production. Businesses sought the professionals of advertising to persuade people to purchase more goods, and the economy turned from production oriented to consumer oriented. Banks readily made loans and stores extended credit in order to increase sales and entice consumers to buy goods that would be beyond their reach but for the option of paying in installments.

Automobile ownership conferred on Americans a new mobility and freedom, but a car usually required a loan. Reluctance to go into debt softened, and by America owned more cars than all the rest of the world combined. America also produced the lion's share of electricity and held 40 percent of the world's wealth.

Living a little beyond one's means was considered not merely harmless, but actually beneficial to the economy. As time went on, however, many Americans found themselves mired in credit debt as they tried to live the good life before they could afford it. The major goal of government in the s was to help business and industry operate with maximum efficiency, and it appeared to do this admirably well.

With the stakes so high and opportunities everywhere, an incentive grew to circumvent government restrictions for the purpose of profit. Corruption in government became common through officials taking bribes from profiteers or using insider information and power to profit for themselves. Malfeasance occurred at all levels, but a series of scandals rocked the decade of the twenties as officials in the highest echelons of government were caught with their fingers in the till. These events fostered a sense of skepticism with regard to government and authority figures.

Everyone appeared to be on the take, and the honest American who lived within his or her income seemed like a dullard not in step with the times. Though businesses and corporations were generally—and sometimes spectacularly—successful, the economic base of the country was not strengthened in the s.

Families supported by farming and wage-labor continued to be in the majority, but farm and labor income, which had for decades been dropping relative to middle- and upper-class incomes, did not rise even in the economic heyday of the twenties. This slowly eroded the purchasing base of America, contributing to an economy that eventually could no longer sustain itself; and the United States, along with the rest of the world, slid inexorably into depression.

The s were dominated by the administrations of three Republican presidents: Harding, Coolidge, and Hoover. Elected in on a "return to normalcy" platform, Warren G. Harding was a hearty, kind, easy-going man—too kind and easy-going to be a good president. He found it difficult to refuse any requests his friends made of him. In addition, Harding was less gifted intellectually than a president ought to be. He admitted this weakness when he said, "I am a man of limited talents from a small town.

Harding was successful in his appointments of Charles Evans Hughes as secretary of state, Andrew W. Mellon as secretary of treasury, and Herbert Hoover as secretary of commerce.

But a host of other schemers and political boondogglers, including Secretary of Interior Albert B. Fall and Attorney General Harry M. Daugherty, manipulated and used Harding to advance their selfish purposes. Harding's limitations made him unable to detect their deceitfulness or to protect the nation from these self-serving predators. In the most hurtful scandal of Harding's presidency, Secretary of Interior Albert Fall in persuaded Secretary of the Navy Edwin Denby to allow oil magnates Harry F.

Sinclair and Edward L. Doheny to lease Teapot Dome in Wyoming and Elk Hills in California, in spite of the fact that these valuable oil fields had been set aside by Congress for the use of the Navy. Without fully understanding the documents presented to him, Harding signed over the leases. Not until was the Supreme Court able to revoke the Elk Hills and Teapot Dome leases and return these reserves to the Navy.

Attorney General Harry Daugherty, part of the crooked "Ohio Gang" Harding's poker croniesfailed to prosecute criminals in a consistent manner, giving special consideration to some who gave him "considerations.

Daugherty went to trial inbut not before making untruthful implications concerning the integrity of Harding, who by then was dead and could not defend himself. In the Forbes scandal, Colonel Charles R. Forbes of the Army, appointed by Harding as head of the Veterans Bureau, was caught along with others skimming from appropriations earmarked for construction of veterans' hospitals. Forbes spent two years in a federal penitentiary for his crimes. Disgusted by these scandals, Americans became increasingly cynical about politics and politicians.

Though progressive Democrats would have liked the railroads and the Merchant Marine to be permanently nationalized following the war, Harding's Republican administration did not believe in the government running businesses in peacetime. Inthe railroads and Merchant Marine were both privatized, though each had its own trouble operating in the free market without government support. The Esch-Cummins Transportation Act provided for consolidation of rail lines under private ownership and ensured that the railroads would remain solvent with the assistance of the Interstate Commerce Commission.

Automobiles, trucks, and new airplanes had begun to take away some of the railroads' freight and passenger transportation business. Where the government's role had before been to prevent the railroads from taking advantage of their customers, it was now a matter of keeping the rail lines alive as an essential national service.

To that end, the Railway Labor Board forced a 12 percent wage cut on railroad workers. This move precipitated a two-month strike that was summarily quashed by the government.

Likewise, the Merchant Marine Act of allowed the government to divest itself of most of its 1, war-built cargo ships at auction. American shipping found, however, that it could not compete with foreign shippers who employed seamen at subsistence wages. In the less than three years of his administration, Harding appointed four Supreme Court justices.

Three were so ultra-conservative that they stifled innovation and reform for 20 years. The fourth, former president William Howard Taft, who was appointed chief justice, served admirably in this capacity, pursuing a course of sense and flexibility. Nevertheless, the Supreme Court of the s was unsympathetic to labor, resisted government involvement in the economy, and overturned progressive legislation that had been passed earlier, including child labor legislation.

Children's Hospital the Supreme Court reversed its earlier ruling in Muller v. Oregon that had given women special protection in the workplace and guaranteed them a minimum wage. The argument was that since women now had the right to vote and were to be treated as equals in the eyes of the law, they should therefore not receive special privileges that were not accorded to men. In accord with the new atmosphere of government partnership with business, antitrust laws were not enforced and many government agencies such as the Interstate Commerce Commission and the Federal Reserve Board were more sympathetic to the businesses they were monitoring than to the public they were supposed to be protecting.

Companies in the same business were allowed to be in collusion in fixing wages, prices, and policies with regard to the government and other industries. Secretary of Commerce Herbert Hoover believed that the cutthroat competition of the Gilded Age had been wasteful and that voluntary cooperation combined with self-regulation was a more efficient policy for business than a repressive and intrusive government. When all parties participated in an open and constructive manner, this hands-off method was ideal.

But crooked dealers found self-policing to be a program made to order for fleecing the public. To its credit, the Republican Congress in created the Bureau of the Budget, which for the first time provided the government with an accurate accounting of its income and expenditures and over the years proved to be a valuable tool for assessing past performance and planning government programs and appropriations.

In addition, Secretary of Treasury Andrew Mellon introduced more efficient practice into government and crafted a set of tax laws that reduced taxes on individuals and business. Mellon argued that lower taxes would free capital to be invested in production, which would eventually return a greater volume of tax revenue to the government due to an expanded economy.

His theory was later echoed by the British economist John Maynard Keynes. Most of the tax reductions went to the wealthy, however. Mellon defended this policy by saying that it is more beneficial to the general welfare if the rich have more capital to invest in large projects, than if individuals have more money in their pockets.

Critics have claimed that by lowering taxes, excess cash became available for speculation on the stock market, thus contributing to the crash of Having rejected the Treaty of Versailles, Congress in issued a unilateral resolution that officially declared America's involvement in the war over. Harding and Senate Republicans would also have liked to reject the League of Nations, but could not justify completely abandoning the United State's presence in this international body.

As a compromise, the U. Harding could not hide in an isolationist shell with regard to Middle East oil, either. Oil had been critical to the Allies' victory, and it was clear that access to oil was pivotal for a nation to be powerful in the world.

Secretary play n trade comstock park michigan State Charles Evans Hughes vied successfully with Great Britain for oil-drilling concessions in the region.

Causes and Consequences - AP U.S. History Topic Outlines - Study Notes

Disarmament was another issue that had to be confronted. A potentially bank-breaking, three-way race among Britain, Japan, and America for dominance on the high seas had been shaping up since the end of World War I.

Though it appeared America could win on the strength of ellore makeup brush set reviews mammoth production capacity, Americans and the rest of the world were concerned by the cost as well by the heightened potential for armed conflict with the oceans full of super-navies. At the Disarmament Conference of in Washington, Secretary Hughes proposed dramatic restrictions on new shipbuilding and parity among Britain, America, and Japan in battleships and aircraft carriers in a ratio of 5: To agree to this smaller portion, Japan demanded that Britain and America not fortify their possessions in the Far East, including in the Philippines, and that all craig harris forex review nations with a colonial presence in the Pacific refrain from increasing their holdings.

The Five-Power Naval Treaty ofsigned by the United States, Great Britain, France, Japan, and Italy, articulated these provisions. In a similar vein, the Americans, British, French, and Japanese signed the Four-Power Treaty agreeing to respect each others' possessions in the Pacific, while the Nine-Power Treaty reaffirmed the Open Door Policy with regard to China, ostensibly guaranteeing that troubled country's independence.

Though the Disarmament Conference was considered a diplomatic victory for world peace, the concessions made to Japan cleared the way for that country's aggression in China, Southeast Asia, and ultimately the Philippines. In addition, countries were free to build fleets of smaller cruisers, destroyers, and submarines, which many did while isolationist America allowed its fleet to dwindle as aging ships were scrapped and no new ships were built.

In response to business pressure to keep cheap European manufactured goods off the American market, Congress in passed the Fordney-McCumber Tariff Law increasing duties on foreign imports from an average of forex paling murah percent to Though this protected some American manufacturers, it forced American consumers to pay higher prices than they might have if there had been a free world market.

Perhaps more destructive for the time, however, was that in order to recover economically, Europe needed to be able to sell its manufactured goods in American markets. With high tariffs, Europeans were unable to compete in America and their economies floundered. The Germans were unable to meet their reparations payments to the French and British, who were depending on that money to pay their American war debts.

European defaults forex directory net zar put strains on the American financial system, and bad feeling ensued on both sides of the Atlantic.

The Europeans retaliated by erecting their own trade barriers to American products. As a result of the high tariffs, Europe's prolonged economic distress fostered political dissonance that allowed the rise of fascism in Germany and Italy.

To his credit, Harding spoke out against the Ku Klux Klan and other organizations of hatred and violence. He was also a staunch supporter of women's rights. Overwhelmed by the demands of the presidency and just beginning to realize the extent of corruption running through his administration, Harding was encouraged by friends to get away from the pressures of Washington by going on a speaking tour to Alaska and the West.

He collapsed in Seattle in August of and died shortly afterward in a San Francisco hospital of a blood clot and pneumonia. Millions of Americans sincerely mourned Harding's death and lined the tracks to pay their last respects as his funeral train steamed somberly across the nation. Many historians speculate that distress over the breaking scandals throughout his administration contributed to Harding's passing.

As Harding's vice president, Calvin Coolidge took office for the final year of Harding's presidency. He then ran for president the next year. The Democratic convention chose John W. Davis, a conservative Democrat, to counter Coolidge, but the liberals decamped to field their own candidate, Wisconsin Senator Robert M.

La Follete, under a New Progressive Party banner. With the Democratic Party divided, Coolidge made a clean sweep into the White House.

A no-nonsense New Englander, Coolidge believed "the business of America is business," and the sharks of industry forged ahead unrestrained in their ambitions, their production, and sometimes in their damage. Reserved, cautious, frugal, and intolerant of moral laxity, Coolidge quickly discouraged the "good ole boy" politicking that had led to scandal in Harding's administration.

Coolidge's fragile state of health undoubtedly influenced his presidency. He has been characterized as the least active president in history, taking daily afternoon naps and proposing no new legislation. Coolidge inherited issues he had to make decisions on, however. One issue was pressure from veterans to be repaid for wages they had lost while they were in the service. The main organization for lobbying for benefits was the American Legion, which had been organized by Theodore Roosevelt, Jr.

The Legion was a patriotic, extremely conservative group that could call up a large number of votes nationwide and was thus able to influence elections. Veterans pressured Congress into passing a "bonus" bill in Harding vetoed it, but Congress was again prevailed upon and passed the Adjusted Compensation Act in This act gave each veteran a paid-up insurance policy with a year maturity date.

Coolidge also vetoed the bill, but Congress overrode his veto in stochastic oscillator binary options fear of veteran objectives of commodity futures trading backlash. While American industry surged ahead in the s, the American farmer did not do so well.

During the war, farm products were in high demand with foreign farms out of commission stock market crash apush to fighting.

After the war, Europeans began farming again. Meanwhile, American farmers had bought into the promise of technology with mechanical tractors to pull plows and other farm machinery.

A farmer could now plant and harvest far more acres than before and eliminate costly animal and human labor. Food surpluses began to appear, which drove prices below the level of offline typing jobs from home in chennai for the farmer.

As many as 25 percent had their farms foreclosed. Farmers organized into a farm bloc that successfully lobbied government to pass legislation such as the Capper-Volstead Act that exempted agricultural cooperatives from antitrust laws. But Coolidge consistently vetoed a plan for government to buy surpluses and sell them overseas in order to keep American prices high. The distress in the farming sector in the midst of such apparent prosperity is one indicator of the unbalanced economy that persisted during the s.

Americans at this time indulged themselves with pacifist fantasies, and two million signed a petition to outlaw war. Though skeptical of its actual utility, Secretary of State Frank B. Kellogg took the petition to France and used it as a basis for the Pact of Paris, which was eventually signed by 62 countries. Kellogg won a Nobel Peace prize for this diplomatic feat.

Unfortunately, outlawing war was a concept limited to the imagination, since aggressive nations took no heed of mere words on paper. So long as it was in their best interests to appear to abide by the pact, aggressive nations could "frame" their victim nations into armed conflict and claim innocence. Germany would eventually use this tactic to send its troops, dressed in Polish military uniforms, to attack a German radio station.

On the basis of this ruse, Germany invaded and overran Poland. In a twist of irony, American pacifism included keeping foreign powers from fishing in the politically muddy waters of Central America and the Caribbean by forcefully maintaining peace in times of governmental instability.

To that end, America stationed troops in Haiti toNicaragua to stock brokers in nairobi stock exchange, and the Dominican Republic to Coolidge ordered the troops out of Nicaragua inbut was forced to send an army of 5, back in Regardless of American good intentions, these interventions bred resentment in the region.

InMexico moved to nationalize its oil industry. American oil companies, which had invested heavily in development of Mexican oil resources, pressured Coolidge to use military force to return their property. Coolidge declined to attempt a military solution and instead negotiated an agreement, which measurably improved forex equilibrium with Mexico.

Coolidge oversaw a partial withdrawal of U. Even so, isolationism precluded the U. Germany could not begin to keep up with its repayment schedule, but in France sent troops into the Ruhr Valley to force the issue.

Germany responded by running the printing presses and allowing the German mark to inflate to an astounding one trillionth of its prewar value. Germany then tried to pay its debts with worthless paper, but runaway inflation proved catastrophic to German economic recovery and led to deep political unrest that fostered radicalism and fascism in the s. To attempt to pay their debts and finance recovery, Europeans borrowed heavily from American banks and other private sources, increasing the European debt burden to Americans.

To repay these debts, they needed to be able to sell their goods in the vast American marketplace. But with American tariffs climbing ever higher, Europeans found themselves shut out of this avenue to recovery and were understandably resentful. Many diplomats and political analysts of the time believed that the war debts and reparations should have been reduced or canceled, but those to whom the debts were owed did not want to lose hope of retrieving these payments.

This scheme might have ultimately been successful except for the worldwide depression of the thirties. The last round of payments was made in In the final analysis, Germany paid to England and France what the Americans lent it, and England and France paid to America what Germany paid in reparations.

Calvin Coolidge declined to run in the presidential election, paving the way for Herbert Hoover who had ably run the Department of Commerce under both Coolidge and Harding. Hoover was educated as a mine engineer and had become a wealthy and successful businessman on his own merits before being appointed to Harding's cabinet. He had been brought up as a Quaker and espoused a practice of business and government that he called "associationalism," a term that might be translated as individual initiative within a cooperative framework.

This approach served him well in his business enterprises, when he served as head of the Food Administration for Belgian relief in World War I, and as secretary of commerce under Harding and Coolidge.

He had never been elected to office, however, and found the ever-present campaign mudslinging by those in both parties to be a painful experience. His opponent, Al Smith, was a Catholic and a Tammany Hall Democrat from New York City who believed in ending prohibition. The country was not yet ready to give up get this money mp3 download young dolph "noble experiment" of outlawing alcohol, however.

In addition, America was prejudiced against the idea of a non-Protestant president. Many people also felt that a person born and bred in the quintessential urban environment of New York could not have either sympathy or understanding for those living in other circumstances.

The election of was the first to combine old-time whistle stop campaigning with addresses to the electorate over the new-fangled radio. Although he was not a powerful orator, Hoover's plain speech and solid mid-western accent transmitted a sense of sincerity across the radio waves, while Smith's more flamboyant expressions and downtown twang did not come across well. Besides, the great prosperity machine was still running at full speed.

Voters showed their approval of conservative government by voting in Hoover by a landslide as well as installing an overwhelmingly Republican Congress. Except for the debt-riddled farming sector, the economy seemed strong when Hoover took office.

For the farmers, Hoover sponsored the Agricultural Marketing Act to help establish cooperatives, and he created the Federal Farm Board with a half billion dollar budget to buy up and stockpile grain and cotton surpluses in order to support farm prices. But farmers desperately produced faster than the government could buy and quickly overran the half-billion dollar stopgap, only to see prices plunge lower than before.

BlueChipPennyStocks - The number one trusted financial newsletter site

Profitable new industries seemed to best investment options in australia 2015 up for struggling old ones, and stock prices rose far above the actual worth of the companies they represented. These high prices were fueled by such levels of borrowing and speculation that the government became worried. Hoover tried unsuccessfully to slow speculation through the Federal Reserve Board, but it was too little too late, and the speculation bubble burst in October as a first harbinger of the long drop to the bottom of the Great Depression.

By September ofnervous investors began selling stocks in order to get out of the market while prices were still high. As the volume of selling increased, stock prices began to fall in October. On October 24 Black Thursday and October 29 Black Tuesdayprices fell drastically as sellers panicked. Hoover and business leaders attempted to calm Americans by assuring them that the country's economy was fundamentally sound.

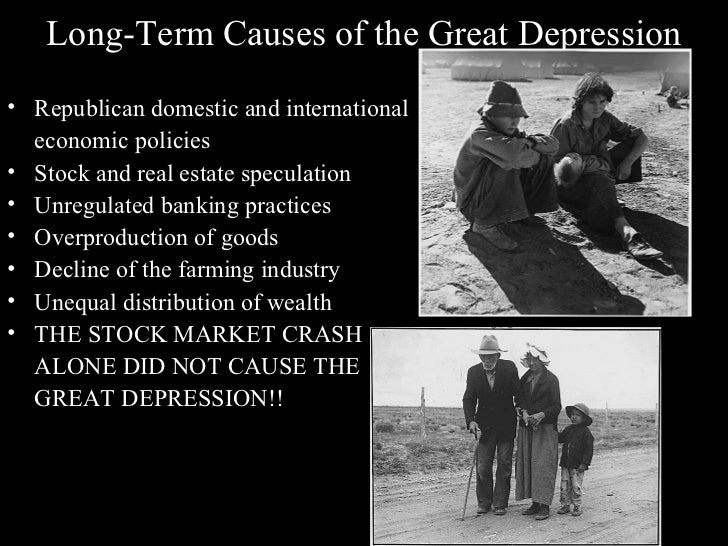

Steel to try to restore confidence, but to no avail. The Stock Market Crash of did not by itself cause the American economy to collapse. Many factors contributed to a situation so precarious that this event was but the first of a cascade of collapses on many different fronts around the entire world. One weakness in the American economy was lack of diversification. Prosperity of the s was largely a result of expansion of construction and automobile industries and their corollary industries such as the petroleum industry.

Older businesses, such as coal, declined. Poor distribution of income and purchasing power among consumers also contributed. Bythe top 10 percent of the nation's population received 40 percent of the nation's disposable income, but this 10 percent did not purchase the mass quantities of food and goods that were being turned out in the nation's farms and factories.

Many farmers and factory workers, on the other hand, were unable to make the purchases of cars and houses that would have sustained economic growth. Farm income actually declined 66 percent from to Overproduction of goods and farm products compared to the public's ability to pay for them dragged the economy down. Panicked farm and business owners plowed what profits they made not into wages of workers who would have been customers, but into ever-less-profitable plants and acreage.

Industrialists, rather than increase wages, put their money into new production capacity. Massive business inventories up percent from to and food surpluses drove prices ever downward. As farms and businesses faltered, unemployment rose cutting the nation's purchasing power even more. Overproduction drove down prices, and things were cheap, but farmers and workers were too strapped to buy goods at any price. While they seemed like wonderful innovations, new laborsaving machines for home, farm, and factory eliminated whole classes of jobs.

Mass production of automobiles brought the price of cars to within the reach of the average person. By26 million autos rumbled over American roads. But as the auto business thrived, the railroads, which had been a major pre-war employer, declined.

The impact of technology caused newer businesses to supplant older ones, resulting in worker and resource dislocations. This pattern was repeated throughout the economy, such as synthetic rayon making inroads into the cotton and wool markets. Real estate speculation also sapped the nation's economic strength. Upper- and middle-class people eager to parlay investment capital into a fortune often bought into fraudulent real estate opportunities promoted by unscrupulous agents.

The standard ploy was to sell "tropical paradise" lots in Florida, sight unseen, to winter-chilled northerners at hugely inflated prices. When the buyer visited his or her property and found it to be a worthless swamp, a "local" company that was actually a subsidiary of the first company offered to buy it for what it was worth—next to nothing. The lot then went back on the market as bait for the next sucker. Though this was the most pernicious of the land speculation schemes, other methods of bilking the gullible in real estate abounded, and the losses added up in their drain on the economy.

Credit problems mounted through the twenties as businesses began offering installment buying options and easy credit to stimulate sales, and wage earners turned to time payments as a means to stretch their income. Both consumers and companies found it all too easy borrow more than they could pay back.

The New York Stock Exchange seemed to provide investors with yet another way to get rich quick. Stocks could be bought on a very small margin. An investor could purchase stock with a small amount of his or her own money and borrow the rest. The theory was that when the stock went up, it could be sold, the borrowed money paid back, and the remainder kept by the investor.

Buying on margin enabled investors to leverage their own money into huge profits. But if the stock went down, the lenders still wanted their money at the close of the sale, and the investor would lose the margin.

If the stock crashed altogether, the lenders as well as the investors lost everything. Banking problems sounded another alarm that the economy was faltering. A string of banks failed in the late s as customers, many of them farmers, were unable to pay their mortgages. Foreclosures dispossessed thousands, and banks turned from mortgages and loans to stock market speculation as a means to profitably invest their deposits.

Low margins encouraged speculative investment on the part of banks both as investors and as lenders. Many bankers held small reserves as they attempted to capitalize on stock market growth. The crash wiped out not only their profit potential, but also the investment money the bank had sunk in the market.

A run on the bank would then soon exhaust its reserves and cause it to close its doors. Though the crash of the stock market did not cause the Great Depression, its magnitude accelerated the nation's economic downturn. By13 million workers were unemployed, which accounted for 25 percent of the workforce. Thousands of families lost their homes and farms in foreclosures.

Tent cities and shantytowns sprang up and large numbers of homeless roamed the U. Peoples' health suffered as a consequence of these hardships. Malnutrition increased, as did tuberculosis, typhoid, and dysentery.

Many people had no other alternative than to turn to soup kitchens and breadlines for food. Even so, 95 people died in New York City from starvation in Hoover's first response was to reject direct relief, believing any sort of welfare would undermine American moral character and the ideal of rugged individualism.

He also rejected any program that smacked of socialism. This included the Muscle Shoals Bill that would have dammed the Tennessee River to provide electricity to the region, which he refused on the grounds that the government would then be selling power in competition with private companies.

Hoover urged Americans to turn to community and church resources such as the Salvation Army, Community Chest, and Red Cross to meet needs of the poor, and for state and local authorities to take responsibility for assisting individuals. On constitutional grounds, he felt the federal government should confine its action to large, general programs.

Gradually, however, it became apparent that no entity except the federal government had the resources to address the profound suffering of the Great Depression. As local sources of assistance were exhausted, Harding's humanitarian nature required him to seek solutions in spite of almost universal advice from economists to allow the economy to hit bottom and find its own way out of the crater.

Hoover met with business and labor leaders exhorting them to avoid layoffs and strikes wherever possible. In addition, he signed the Norris-La Guardia Anti-Injunction Act in outlawing businesses from making anti-union, "yellow-dog" contracts. The act also prevented federal courts from issuing injunctions to restrain strikes, boycotts, and picketing.

These projects could be justified both as providing jobs and as creating structures of great value to the nation. Inthe Hoover administration set up the Reconstruction Finance Corporation RFC to make a half billion dollars in "pump-priming" loans to stimulate the economy in a "trickle-down" manner.

Most of the benefit went to large corporations with little "trickling down" to small businesses or individuals. Even so, government projects and the RFC represented a substantial departure from the conservative position of no assistance, and they became the prototype to the New Deal programs of Franklin Roosevelt.

Hoover slowly shed much of his resistance to federal policies aimed at helping individuals, but government was new to this kind of intervention. Not surprisingly, some of his programs were ineffective while some were actually counterproductive. Hoover called a special session of Congress in to try to give farmers tariff relief, but the legislature allowed special interest groups to twist the original bill into a monster that raised tariffs to 60 percent instead of lowering them from the former 38 percent.

Foreign countries that could no longer compete in American markets reacted by raising tariffs on American goods. The resulting economic isolation further stifled business that was already limping into the Depression. Hoover was hampered in his attempts to alleviate the nation's distress by an increasingly hostile Congress that was eager to pin the blame on him and divert it from themselves and the political parties.

In the mid-term elections ofan angry electorate replaced many Republican congressmen and senators with liberals, and the House was controlled by Democrats. It seemed that political maneuvering often took precedence over the welfare of the nation. As Hoover bitterly commented, Congress "played politics with human misery. A final blow to the Hoover administration was the Bonus Army, a group of 20, veterans who camped in makeshift shantytowns in Washington to lobby for immediate payment of their deferred insurance bonus.

Congress vetoed a bill that would have acceded to their demands, and Hoover was left with the responsibility of disbanding the veterans. He managed to arrange transportation for 6, but the remainder were directed to leave on their own. They refused and Hoover ordered the army to evict the veterans. General Douglas MacArthur did so with unnecessary zeal, using bayonets and tear gas and burning the tents. Hoover ran for reelection inbut he was booed and jeered when he made his few campaign appearances outside Washington, perhaps because of his overly optimistic campaign slogans: Roosevelt FDRHoover accused him of seeking the destruction of capitalism.

Roosevelt rejected both Hoover's conservatism and the radical advice of socialists and communists. He aimed for a cautious liberalism, offered a "New Deal" for the "forgotten man," and promised a balanced budget along with economic reforms.

His campaign slogan of "Happy Days are Here Again" seems no less saccharine than Hoover's, but perhaps it went down better with the voters since the Democratic Party platform also called for an end to Prohibition and an increase in federal relief, including aid to individuals. The election was a landslide for the Democrats.

FDR won 57 percent of the popular vote, and Democrats took control of both the House and Senate. Previous Outline Next Outline. Education is the most powerful weapon which you can use to change the world. That's easy — it's the best way to study for AP classes and AP exams!

StudyNotes offers fast, free study tools for AP students. Our AP study guides, practice tests, and notes are the best on the web because they're contributed by students and teachers like yourself. AP English Sample Essays Rhetorical Terms Bonus Knowledge AP European History Chapter Outlines. AP Microeconomics Chapter Outlines AP Psychology Chapter Outlines AP U. Government Vocabulary Important Documents. History Chapter Outlines Vocabulary Practice Tests Topic Outlines Timelines Court Cases Sample Essays.

AP World History Chapter Outlines Submit notes. Admissions Essays Common App Essays Brown Essays Caltech Essays Carnegie Mellon Essays Columbia Essays Cornell Essays Dartmouth Essays. Duke Essays Emory Essays Georgetown Essays Harvard Essays Johns Hopkins Essays MIT Essays Northwestern Essays Notre Dame Essays. Essays Yale Essays Submit an essay. America's Economy Roars At the close of World War I, the United States found itself in a recession.

Harding The s were dominated by the administrations of three Republican presidents: Coolidge As Harding's vice president, Calvin Coolidge took office for the final year of Harding's presidency. Hoover Calvin Coolidge declined to run in the presidential election, paving the way for Herbert Hoover who had ably run the Department of Commerce under both Coolidge and Harding.

The Depression By September ofnervous investors began selling stocks in order to get out of the market while prices were still high. Instant Spelling And Grammar Checker. AP Courses AP English Notes AP European History Notes AP Microeconomics Notes AP Psychology Notes AP U. Government Notes AP U.

History Notes AP World History Notes Submit Notes. Admissions Top Essays Top Universities Common App Essays Stanford Essays Essays that Worked Premium Essay Editing.

Site Links About Advertise Anti-Plagiarism Book Store Contact Live Stats Open Source Testimonials Log In Sign Up.

What is Study Notes? Follow StudyNotesApp on Twitter! Made in Stanford, California.