Dividend option arbitrage

If a stock pays a discrete dividend, the stock price falls by the amount of the dividend. There is no arbitrage opportunity from this predictable jump, because the investors receive the same amount of price depreciation back in cash from the dividend. But how about options? If the underlying jumps down at the dividend payment, the call option holder receives a direct loss without any compensation in cash as the dividend is only paid to the stock owners and the stock price is now worth less for exercise.

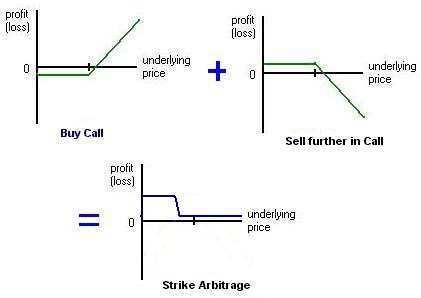

So isnt there an arbitrage opportunity to short all call before the dividend and buy them back cheaper afterwards? It does not matter whether the reason is in dividends or anything else.

Consider the situation of the European calls, and suppose that both the volatility and the drift are zero.

The stock is at a , and there is gonna be a dividend of 4 before expiry. At the same time, American call would still be 10 worth since you would exercise it just before the dividend drop out time. Essentially, when pricing option around dividend one makes sure that the price of the option along the path of the stock which does feature the jump stay continuous: Joshi also has that. That's done exactly to avoid arbitrage.

SGQI - SG Global Quality Income ETF | Janus Henderson Investors

It's like you know in advance that your call would not be worth that much, so why would you buy it for such price? Generally no, because 'dividends' are already 'priced into' the options.

Dividend Arbitrage Explained | Online Option Trading Guide

Which means, if an ATM call cost 0. By posting your answer, you agree to the privacy policy and terms of service. By subscribing, you agree to the privacy policy and terms of service.

Sign up or log in to customize your list. Stack Exchange Inbox Reputation and Badges. Questions Tags Users Badges Unanswered. Quantitative Finance Stack Exchange is a question and answer site for finance professionals and academics. Join them; it only takes a minute: Here's how it works: Anybody can ask a question Anybody can answer The best answers are voted up and rise to the top. Option arbitrage with dividends? Ulysses 2 Decided to change it to 4, but not everywhere apparently, thanks for spotting this.

Victor 4 Can you show a model for this? Black Scholes with discrete dividends? Sign up or log in StackExchange. Sign up using Facebook. Sign up using Email and Password. Post as a guest Name.

In it, you'll get: The week's top questions and answers Important community announcements Questions that need answers. Quantitative Finance Stack Exchange works best with JavaScript enabled. MathOverflow Mathematics Cross Validated stats Theoretical Computer Science Physics Chemistry Biology Computer Science Philosophy more 3.

Meta Stack Exchange Stack Apps Area 51 Stack Overflow Talent.