Forex trading trade the fakey setup

In this video I discuss price action on the EURUSD daily chart, I keep my charts very simple, a moving average is the only indicator I use, I believe that price action and modern day technical price analysis is what makes serious money in the forex market.

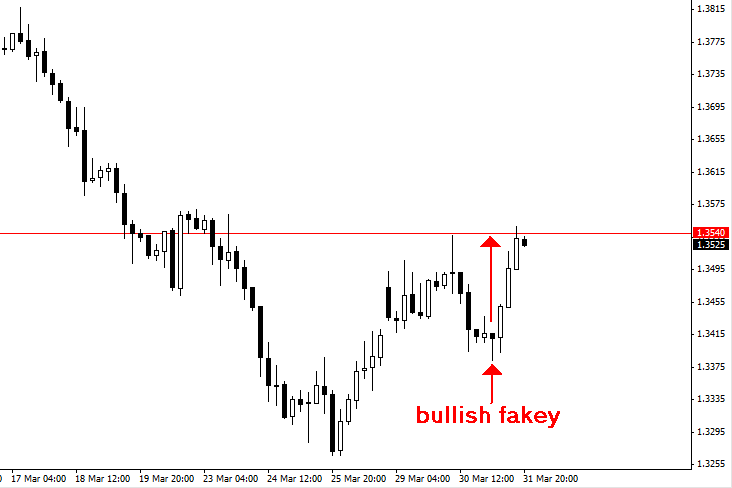

Remember, the higher the time frame the higher the probability of the setup, I wake up in the morning and preempt what is going to happen, or what I think will happen by drawing important levels on my charts and making notes. In the setup in this video I discuss an inside bar that formed near the highs of that time, the high of the inside bar broke to the upside marginally, and then the market got faked out; or a fakey signal formed, this is when there is a false break of an inside bar or an important level.

In the inside bar setup in this video the market faked out to the upside and then rotated lower as sellers pushed the price down. This setup provided a 3 to 1 winner; this means you make 3 times what you risk.

How to Trade the Inside Bar False Break Setup or the Fakey

The second trade in this video was actually a loss. Pro traders take money from the amateurs, the fakey setup is a way that you can learn to take money from the less informed or amateur traders.

Most retail traders lose, this means when amateurs buy most professionals are selling, or vice versa. This is a good example of contrarian trading, you must learn to think contrarian if you want to profit in forex, I am a contrarian trader. This video of the forex fakey trade setup is an excellent learning tool for people interested in contrarian trading.

We have the live trader forum, but not a live trading room or chat, thats not possible, we dont trade that often, we are not gamblers and not day traders in any way shape or form.

Advanced Price Action Trading Strategies for Gold Forex Trading

Hi Nial If there are no signals currently on a daily chart, do you move to a 4 hour chart and if no signals there do you drop to an hourly chart. Is it the same methodolgy used for each time frame, or does your course teach several methods and different chart patterns. There is different methods for different timeframes, however a trader is best off suited to playing only one or two chart timeframes. There is a common theme to the methods I teach for all timeframes, however intraday timeframes have more flexibility when it comes to trading with or against current momentum on higher timeframes.

On the 3rd setup in this clip for eg. Is it immediately after the pull back from the false break or do you wait until the candle is formed completely. False breaks from inside bars are covered in depth in the trading course. Your email address will not be published.

Notify me of follow-up comments by email. Notify me of new posts by email. Any Advice or information on this website is General Advice Only - It does not take into account your personal circumstances, please do not trade or invest based solely on this information. By Viewing any material or using the information within this site you agree that this is general education material and you will not hold any person or entity responsible for loss or damages resulting from the content or general advice provided here by Learn To Trade The Market Pty Ltd, it's employees, directors or fellow members.

Futures, options, and spot currency trading have large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don't trade with money you can't afford to lose. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed in any material on this website.

The past performance of any trading system or methodology is not necessarily indicative of future results. Forex, Futures, and Options trading has large potential rewards, but also large potential risks. The high degree of leverage can work against you as well as for you. You must be aware of the risks of investing in forex, futures, and options and be willing to accept them in order to trade in these markets.

Forex trading involves substantial risk of loss and is not suitable for all investors. Please do not trade with borrowed money or money you cannot afford to lose.

Any opinions, news, research, analysis, prices, or other information contained on this website is provided as general market commentary and does not constitute investment advice. We will not accept liability for any loss or damage, including without limitation to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information. Please remember that the past performance of any trading system or methodology is not necessarily indicative of future results.

Now I want to hear from you! February 21, at 9: October 11, at February 23, at July 6, at April 18, at 6: April 18, at 7: April 17, at April 16, at 4: April 16, at 9: Leave a Comment Cancel reply Your email address will not be published. Categories Forex Trading Commentary Forex Trading Videos Forex Trading Strategies Forex Trading Articles Trading Lessons Blog Forex Trading Blog Trading Tools.

Nial Fuller Learn To Trade Forex Price Action Trading Nial Fuller Reviews Beginners Forex Trading New York Close Charts Forex Broker.

Copyright Learn To Trade The Market.