Valuing call option on bond

Founded in by brothers Tom and David Gardner, The Motley Fool helps millions of people attain financial freedom through our website, podcasts, books, newspaper column, radio show, and premium investing services. If a bond is "callable," it means that the issuer has the right to buy the bond back at a predetermined date before its full maturity date.

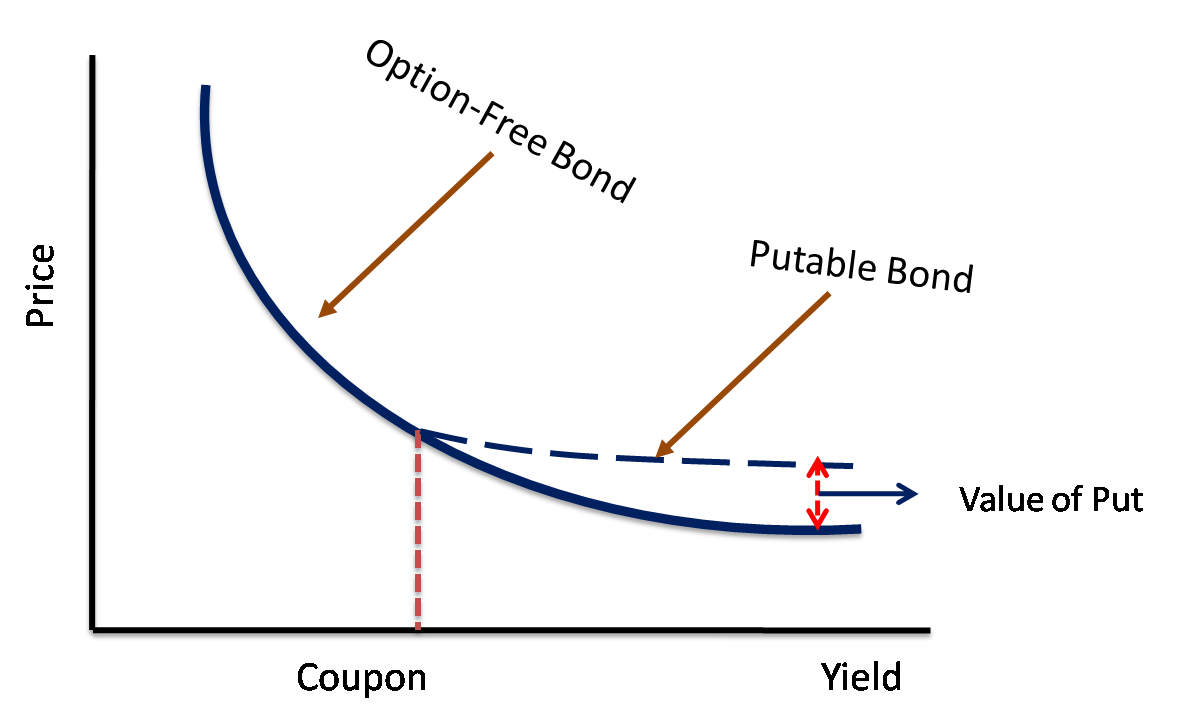

Bond Pricing, Valuation, Formulas, and Functions in ExcelThe call could happen at the bond's face value, or the issuer could pay a premium to bondholders if it decides to call its bonds early. For callable bonds, knowing the coupon rate and yield to maturity only tells you part of the story.

To make informed investment decisions, you need to know what the bond's yield would be if it were called, since oftentimes this is lower than the other yield figures might lead you to believe.

With that in mind, here's how to calculate yield to call for your bonds. Calculating yield to call Because bonds don't usually trade for exactly their face value or call price, calculating yield-to-call YTC has to take two main factors into account. First, there is the obvious yield that comes from the interest payments you'll get between now and the call date.

In addition, there is a component of yield that comes from the difference between the bond's market price and the payment you would get if the bond were to be called. Looking at the numerator of this formula, the left side coupon interest payment accounts for the annual dividend payments and the right side annualized the discount or premium you would pay to buy the bond.

Putting this together gives you the total annual effective interest from now until the call date. Finally, dividing by the average of the call price and the market value will convert this annual interest amount into a rate.

Multiply the final result by to convert to a percentage. So, since you were able to buy this bond at a discount to par value, its yield to call is actually more than if you hold the bond to maturity.

Pricing Bonds

Now time to put that information to good use -- by picking an online broker and getting started investing today! This article is part of The Motley Fool's Knowledge Center, which was created based on the collected wisdom of a fantastic community of investors. We'd love to hear your questions, thoughts, and opinions on the Knowledge Center in general or this page in particular.

The Value of the Call Option on a Bond on JSTOR

Your input will help us help the world invest, better! Thanks -- and Fool on! Try any of our Foolish newsletter services free for 30 days. We Fools may not all hold the same opinions, but we all believe that considering a diverse range of insights makes us better investors.

The Motley Fool has a disclosure policy. Skip to main content The Motley Fool Fool.

Premium Advice Help Fool Answers Contact Us Login. Latest Stock Picks Stocks Premium Services. Stock Advisor Flagship service. Rule Breakers High-growth stocks. Income Investor Dividend stocks.

CFA Level II: LOS 50 - Valuing Bonds with Options Flashcards | Quizlet

Hidden Gems Small-cap stocks. Inside Value Undervalued stocks. Learn How to Invest. Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

Mortgages Compare Mortgage Rates Get Pre-Approved How Much House Can I Afford?

Taxes How to Reduce Your Taxes Deductions Even Pros Overlook Audit-Proof Your Tax Return What Info Should I Keep? Helping the World Invest — Better. How to Invest Learn How to Invest. Personal Finance Credit Cards Best Credit Cards of Best Credit Card Sign-Up Bonuses Best Balance-Transfer Credit Cards Best Travel Credit Cards Best Cash-Back Credit Cards Best No-Annual-Fee Credit Cards Best Small Business Credit Cards.

How to Calculate Yield for a Callable Bond If your bonds are callable, you need to know how the potential call affects your yield. Here is the YTC formula, followed by some information about it: How to Invest in Stocks. Prev 1 2 3 4 Next.