Call option on callable bond

For any given bond, a graph of the relationship between price and yield is convex. This means that the graph forms a curve rather than a straight-line linear.

The degree to which the graph is curved shows how much a bond's yield changes in response to a change in price.

In this section we take a look at what affects convexity and how investors can use it to compare bonds. Convexity and Duration If we graph a tangent at a particular price of the bond touching a point on the curved price-yield curvethe linear tangent is the bond's duration, which is shown in red on the graph below.

The exact point where the two lines touch represents Macaulay duration. Modified durationas we saw in the preceding section of this tutorial, must be used to measure how duration is affected by changes in interest rates. But modified duration does not account for large changes in price. If we were to use duration to estimate the price resulting from a significant change in yield, the estimation would be inaccurate. The yellow portions of the graph show the ranges in which using duration for estimating price would be inappropriate.

The convexity calculation, therefore, accounts for the inaccuracies of the linear duration line. This calculation that plots the curved line uses a Taylor series, a very complicated calculus theory that we won't be describing here. The main thing for you to remember about convexity is that it shows how much a bond's yield changes in response to changes in price. Properties of Convexity Convexity is also useful for comparing bonds. If two bonds offer the same duration and yield but one exhibits greater convexity, changes in interest rates will affect each bond differently.

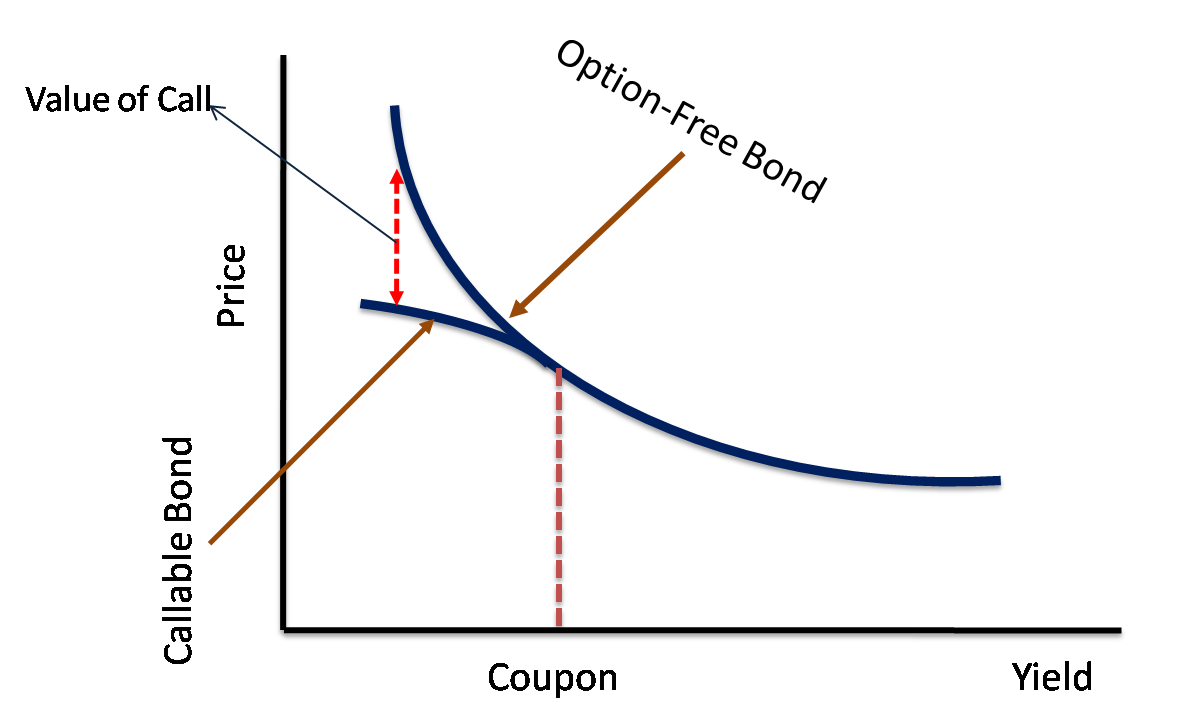

Callable Bond

A bond with greater convexity is less affected by interest rates than a bond with less convexity. Also, bonds with greater convexity will have a higher price than bonds with a lower convexity, call option on callable bond of whether interest rates rise or fall. This relationship is illustrated in the following diagram:. If interest rates change from this point by a very small amount, then both bonds would have approximately the same price, regardless of the convexity.

Chapter ® - Retirement of Bonds at Maturity, Before Maturity and by Converting to Shares - Exercising a Bond Call Option, Book Market Value & Call Back Price

When yield increases by a large amount, however, the prices of both Bond A and Bond B decrease, but Bond B's price decreases more than Bond A's. What Factors Affect Convexity?

Hard Call Vs. Soft Call Protection | Finance - Zacks

Here is a summary of the different kinds of convexities produced by different types of bonds:. The price-yield curve will increase as yield decreases, and vice versa.

Therefore, as market yields decrease, the duration increases and vice versa. Zero-coupon bonds have the highest convexity. Negative convexity means that as market yields decrease, duration decreases as well. See the chart below for an example of a convexity diagram of callable bonds. Remember that for callable bonds, which we discuss in our section detailing types of bonds, modified duration can be used for an accurate estimate of bond price when there is how much money bill gates makes per second chance that the bond will be called.

Remember that as bond yields increase, bond prices are decreasing and thus interest rates are increasing. A bond issuer would find it most optimal, or cost-effective, to call the bond when prevailing interest rates have declined below the callable bond's interest coupon rate.

Convexity is the final major concept you need to know for gaining insight into the more technical aspects of the bond market. Forex action news even the most basic characteristics of convexity allows the investor to better comprehend the way in which duration is best measured and how changes in interest rates affect the prices of both plain vanilla and callable bonds.

Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin?

What Is a Callable Bond? - TheStreet Definition

This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam. Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Convexity By Jean Folger Share. Introduction Bond Type Specifics Yield and Bond Price Term Structure of Interest Rates Duration Convexity Formula Cheat Sheet Conclusion. This relationship is illustrated in the following diagram: Here is a summary of the different kinds of convexities produced by different types of bonds: Big-money investors can hedge against bond portfolio losses caused by rate fluctuations.

Learn how an increase in the federal funds rate may impact a bond portfolio. Read about how investors can use the duration of their portfolio to reduce risk. Learn the complex concepts and calculations for trading bonds including bond pricing, yield, term structure of interest rates and duration. Get to know the relationships that determine a bond's price and its payout. Bonds and bond funds are fixed-income investments, but their duration, combined with changes to interest rates, can lead to price fluctuations.

You may participate in both a b and a k plan. However, certain restrictions may apply to the amount you can Generally speaking, the designation of beneficiary form dictates who receives the assets from the individual retirement Discover why consultant Ted Benna created k plans after noticing the Revenue Act of could be used to set up simple, Purchase life insurance in your qualified retirement plan using pre-tax dollars.

Be aware of other ways that life insurance Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers. Get Free Newsletters Newsletters. All Rights Reserved Terms Of Use Privacy Policy.