What are etfs in the stocks market

An ETF, or exchange traded fund, is a marketable security that tracks an index, a commodity , bonds , or a basket of assets like an index fund. Unlike mutual funds , an ETF trades like a common stock on a stock exchange. ETFs experience price changes throughout the day as they are bought and sold.

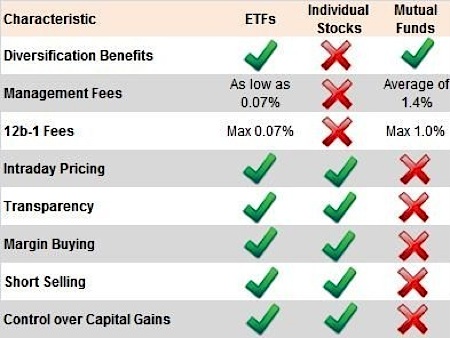

ETFs typically have higher daily liquidity and lower fees than mutual fund shares, making them an attractive alternative for individual investors.

What are Mutual Funds, Index Funds, & ETF's and How to Evaluate ThemBecause it trades like a stock, an ETF does not have its net asset value NAV calculated once at the end of every day like a mutual fund does. An ETF is a type of fund which owns the underlying assets shares of stock, bonds, oil futures, gold bars, foreign currency, etc. The actual investment vehicle structure such as a corporation or investment trust will vary by country, and within one country there can be multiple structures that co-exist.

Shareholders do not directly own or have any direct claim to the underlying investments in the fund; rather they indirectly own these assets. ETF shareholders are entitled to a proportion of the profits, such as earned interest or dividends paid, and they may get a residual value in case the fund is liquidated.

10 Best Growth-Stock ETFs for - TheStreet Ratings

The ownership of the fund can easily be bought, sold or transferred in much the same was as shares of stock, since ETF shares are traded on public stock exchanges. Find the best online brokers to start investing in ETFs here.

The supply of ETF shares are regulated through a mechanism known as creation and redemption. APs are large financial institutions with a high degree of buying power , such as market makers that may be banks or investment companies.

Only APs can create or redeem units of an ETF. When creation takes place, an AP assembles the required portfolio of underlying assets and turns that basket over to the fund in exchange for newly created ETF shares. Similarly, for redemptions , APs return ETF shares to the fund and receive the basket consisting of the underlying portfolio.

By owning an ETF, investors get the diversification of an index fund as well as the ability to sell short , buy on margin and purchase as little as one share there are no minimum deposit requirements.

Another advantage is that the expense ratios for most ETFs are lower than those of the average mutual fund. When buying and selling ETFs, you have to pay the same commission to your broker that you'd pay on any regular order.

What Are ETFs? - Fidelity

There exists potential for favorable taxation on cash flows generated by the ETF, since capital gains from sales inside the fund are not passed through to shareholders as they commonly are with mutual funds. Dictionary Term Of The Day. A measure of what it costs an investment company to operate a mutual fund. Latest Videos PeerStreet Offers New Way to Bet on Housing New to Buying Bitcoin? This Mistake Could Cost You Guides Stock Basics Economics Basics Options Basics Exam Prep Series 7 Exam CFA Level 1 Series 65 Exam.

Sophisticated content for financial advisors around investment strategies, industry trends, and advisor education.

Exchange-Traded Fund ETF Share. ETF Of ETFs Stock ETF Index ETF Redemption Mechanism Inverse ETF Creation Unit Commodity ETF IPO ETF Passive ETF. Content Library Articles Terms Videos Guides Slideshows FAQs Calculators Chart Advisor Stock Analysis Stock Simulator FXtrader Exam Prep Quizzer Net Worth Calculator. Work With Investopedia About Us Advertise With Us Write For Us Contact Us Careers.

Get Free Newsletters Newsletters.

All Rights Reserved Terms Of Use Privacy Policy.